Transact securely

Be wary when shopping on e-commerce sites

-

When making online purchases, check the reviews of the seller, and look out for potential tell-tale signs of scams

-

Always pay using the secured payment options offered by the platforms. Do not take transactions off-platform, especially when making payment. A common scam tactic is to lure victims to messaging platforms such as WhatsApp or Telegram, and direct victims to make banks transfers for items.

-

Be wary of deals that seem too good to be true. Exercise caution when encountering heavily discounted or unrealistic deals, as they may be indicative of fraudulent activity.

-

Check the safety ratings of e-commerce platforms by referring to the E-commerce Marketplace Transaction Safety Ratings (TSR)

Safeguard banking details and lower transaction limits

Falling prey to scammers can have significant repercussions, including financial loss, identity theft, and emotional distress, jeopardizing hard-earned money and financial stability. Prioritizing safe banking practices is essential to mitigate these risks and safeguard personal and financial well-being. Some ways to do so include lowering your bank transaction limits, setting a low threshold for funds transfer transaction notifications, including for PayNow, and staying alert to all transaction notifications so that any unauthorised payments are reported as soon as possible to increase the chances of recovery.

Adopting good digital banking hygiene practices

Add ScamShield App and security features (e.g. enable Two-Factor Authentication (2FA), Multifactor Authentication for banks).

Refrain from giving out personal information and bank details (such as your internet bank account usernames, passwords, OTP codes from tokens), whether on a website or to callers over the phone.

Activate the emergency self-service “kill switch” to suspend your bank account quickly if you suspect that your bank account has been compromised.

Enable Money Lock

Money Lock secures a portion of your bank savings to further protect it against scams. Speak to your bank for more information on how to add Money Lock.

Click here to find out more about Money Lock.

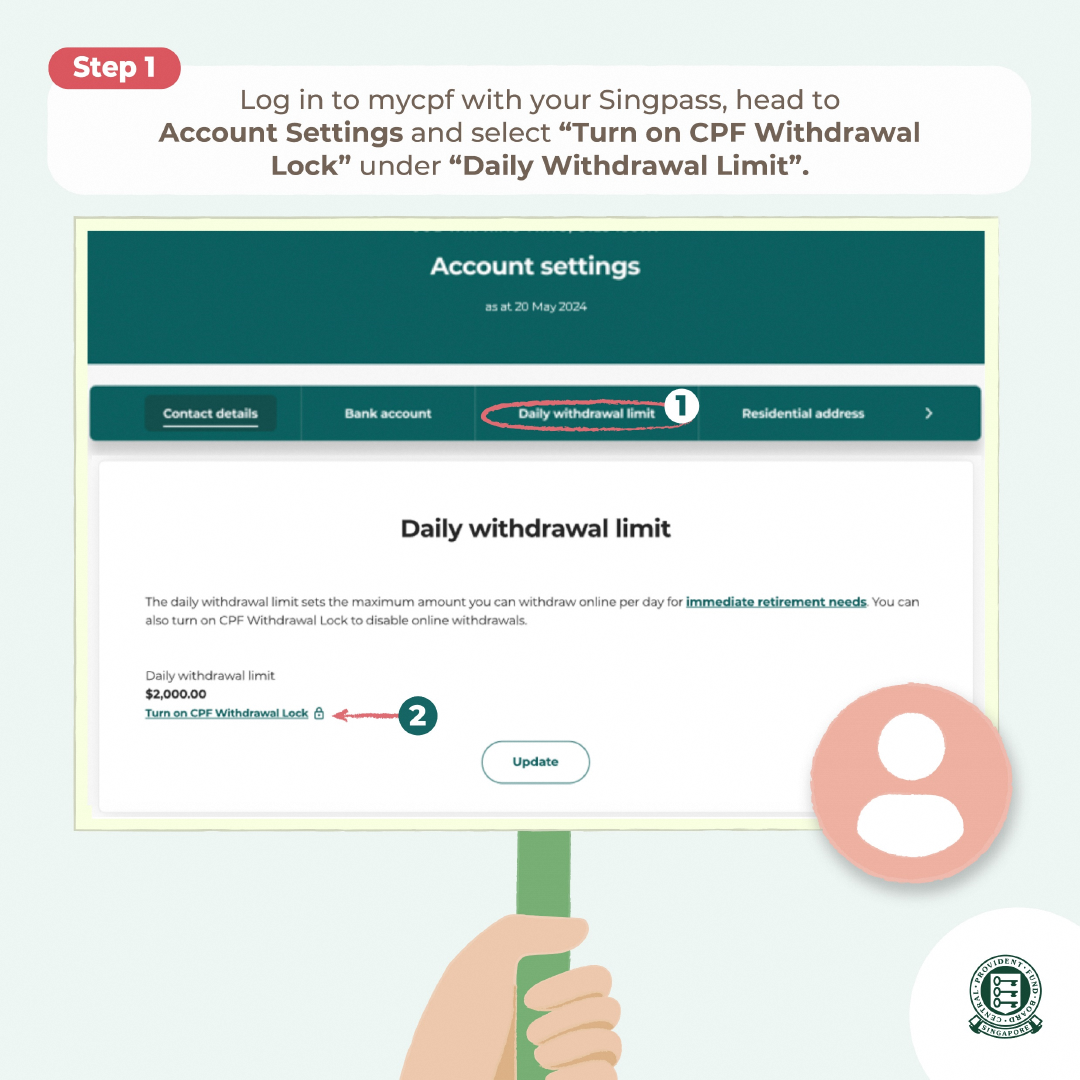

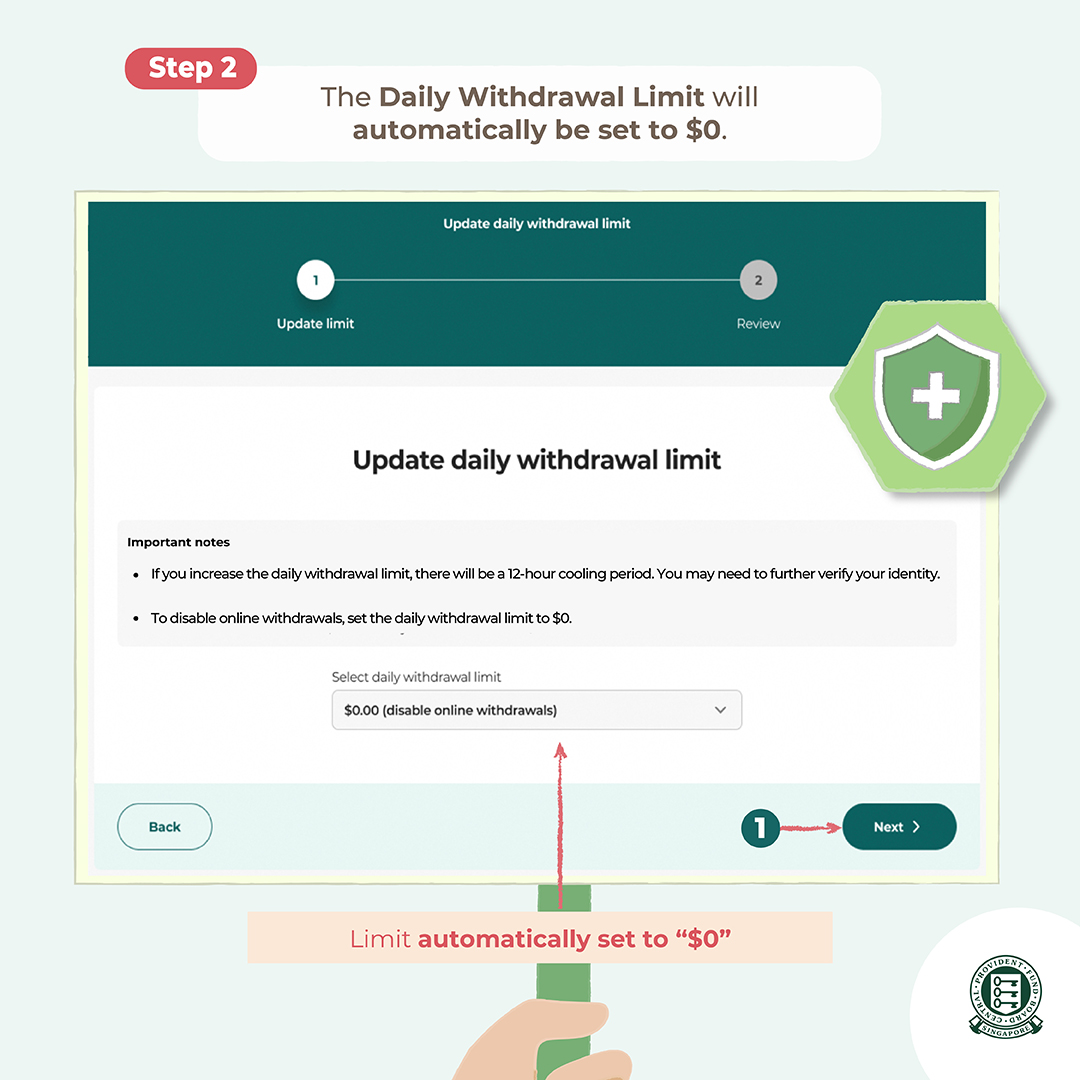

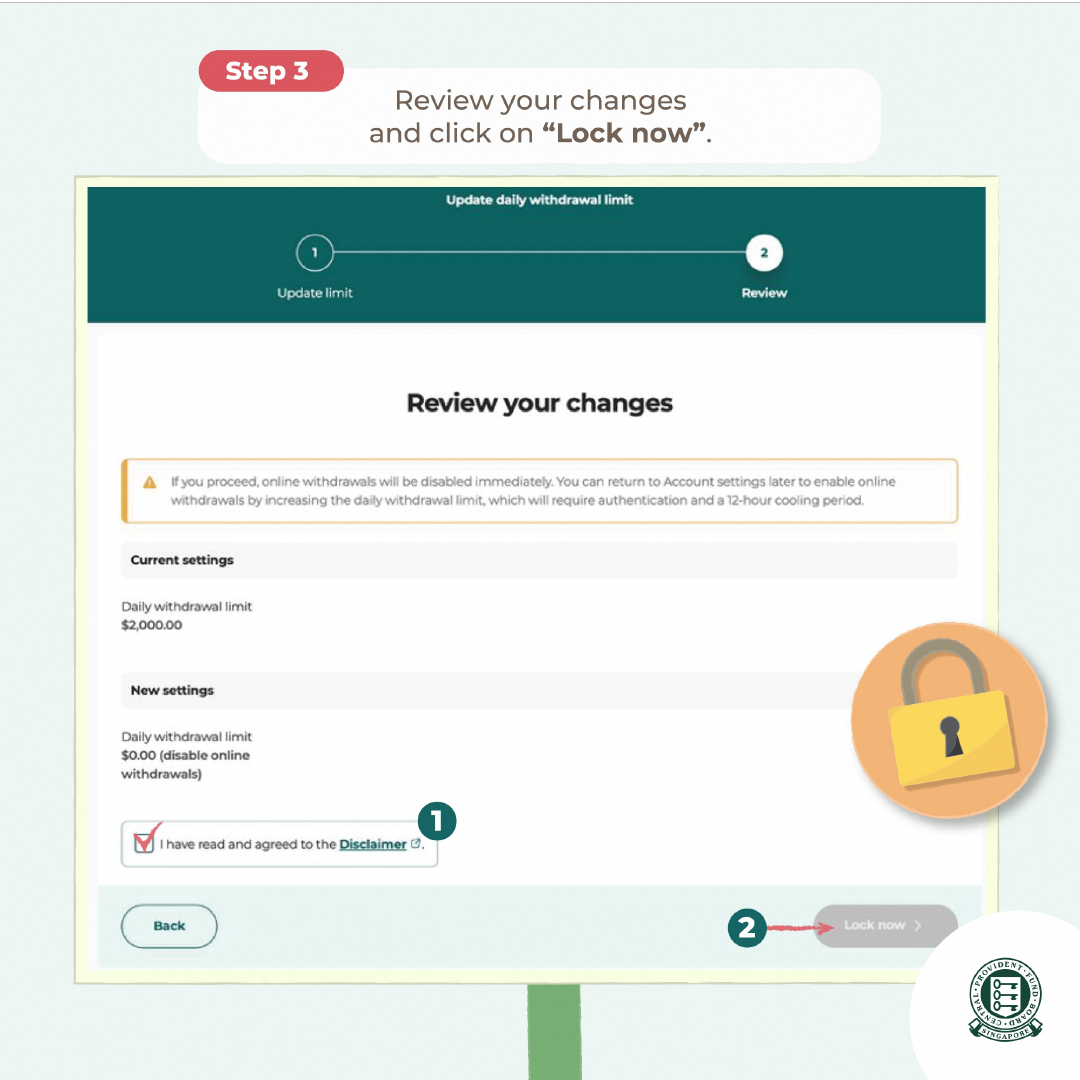

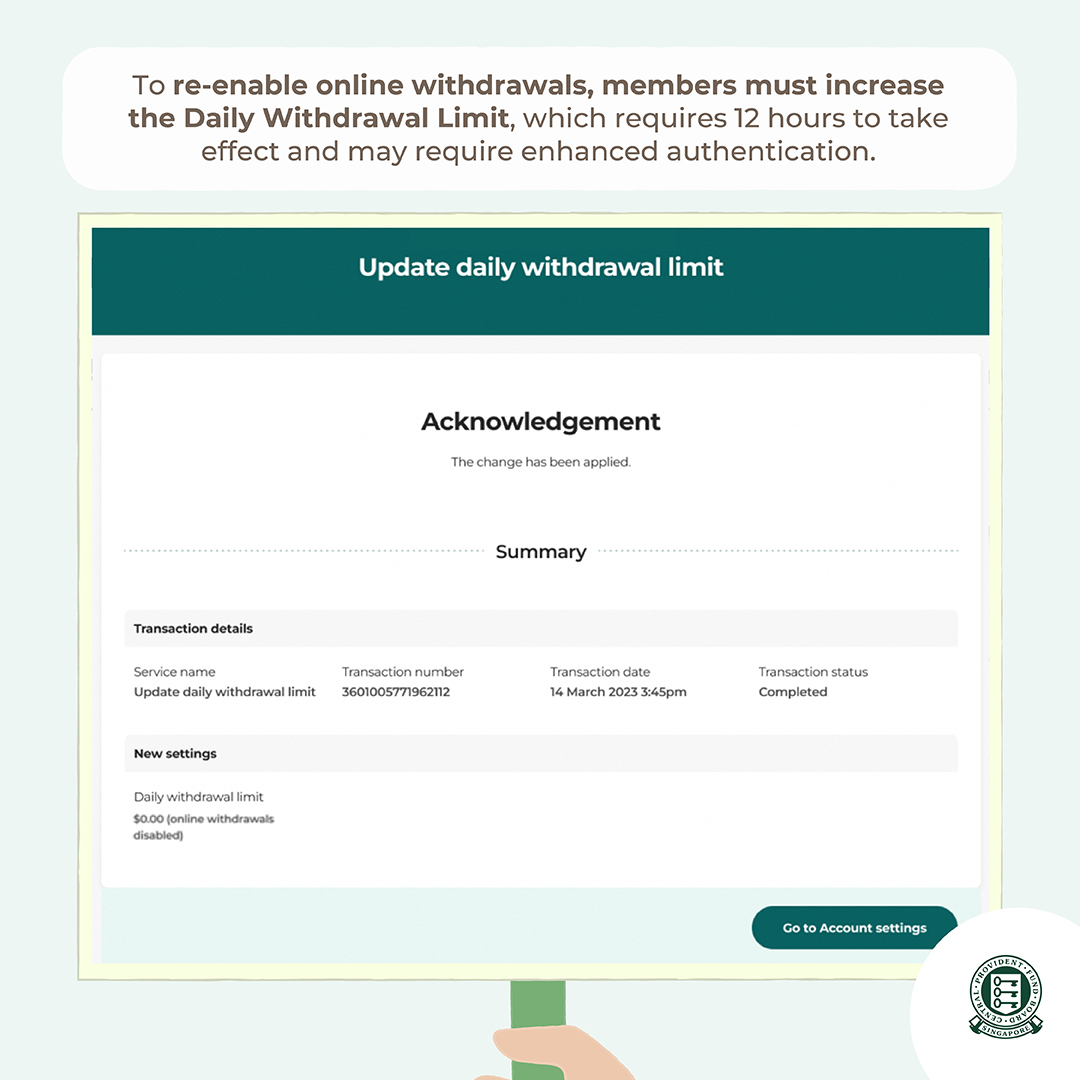

CPF Withdrawal Lock and online Daily Withdrawal Limit

If you are aged 55 and above, the default online Daily Withdrawal Limit is automatically set at $2,000 per day.

If you have no immediate plans to withdraw your CPF savings, you are encouraged to safeguard your CPF savings by activating the CPF Withdrawal Lock to disable online withdrawals.

How to disable CPF online withdrawals

|

|

|---|---|

|

|

The online Daily Withdrawal Limit and CPF Withdrawal Lock complement CPFB’s existing security measures, which include Singpass Two-Factor Authentication (2FA) and ensuring that your CPF savings can only be paid to bank accounts that are verified as belonging to you. You will also receive instant notifications of any CPF withdrawals and adjustments to your online Daily Withdrawal Limit or bank account details registered with CPFB.

Click here to find out more about CPFB’s anti-scam measures.